一、Industry status quo

1.Production and sales

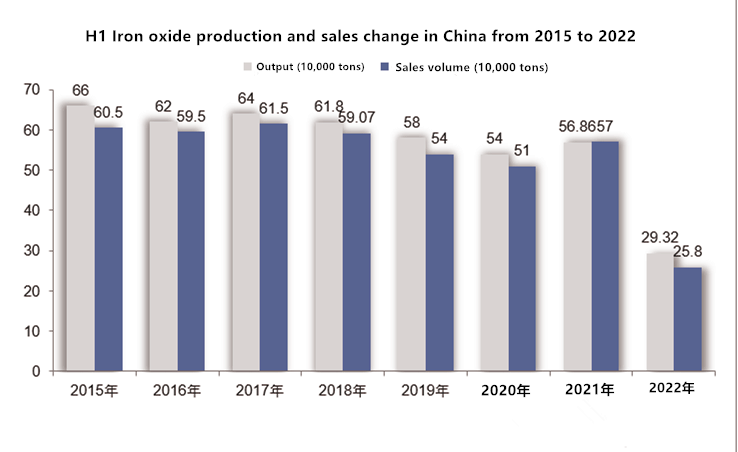

improvement of product quality requirements in the market, a large number of iron oxide production enterprises have closed down due to the environmental protection standards and low quality of production products, and the overall production and sales of iron oxide have shown a downward trend.

According to the data, the output of iron oxide in 2021 is 568,600 tons, with a year-on-year increase of 5.3%. Sales volume was 570,000 tons, up 11.8 percent year on year. By the end of the first half of 2022, China's iron oxide production was 293,200 tons, up 2.9% year on year; Sales volume was 273,500 tons, down 5.7 percent year-on-year.

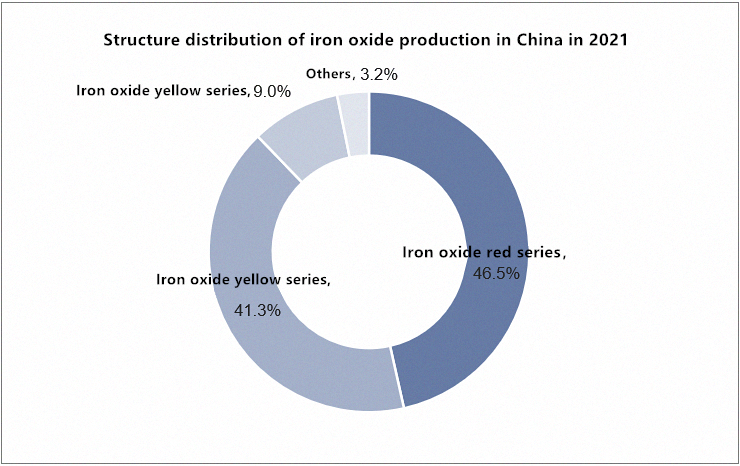

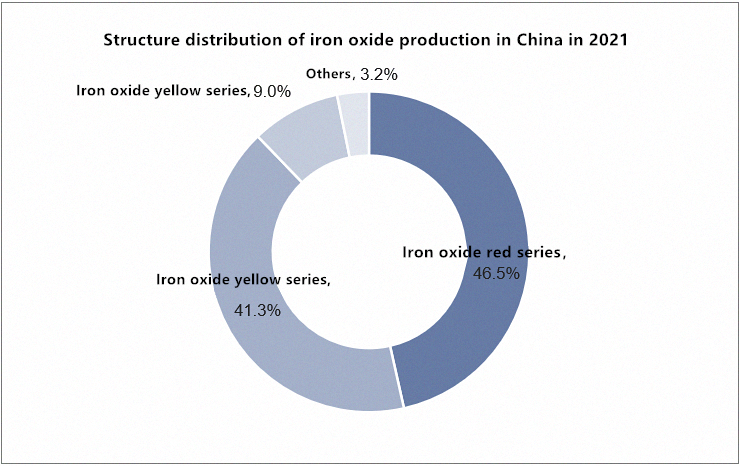

From the perspective of output structure, in the output of iron oxide in 2021, the output of special red series is 264,300 tons, accounting for 46.5% of the total output of iron oxide products. The output of iron yellow series was 234,800 tons, accounting for 41.3% of the total output. The production of iron oxide black series was 51,100 tons, accounting for 9 percent of the total production.

2.Market size

In recent years, under the influence of increasing economic downward pressure, continuous upgrading of environmental protection policies, the downward trend of the real estate industry downstream coating terminal, the demand of the domestic iron oxide market has been declining, which leads to the continuous decline of the market size of the domestic iron oxide industry. In 2021, driven by foreign trade, the market size rebounded. According to the data, the market scale of China's iron oxide industry in 2021 is about 2.2 billion yuan, with a year-on-year growth of 54.3%.

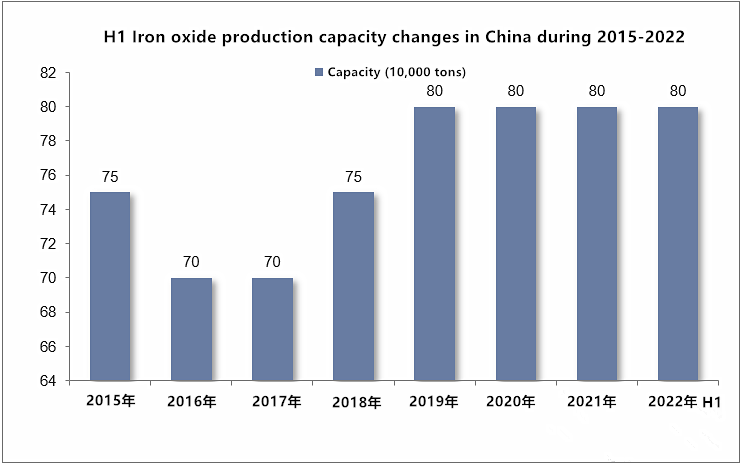

3.Capacity

In recent years, China's iron oxide production capacity has basically remained stable, with the industry's production capacity relatively stable at 800,000 tons during the first half of 2019-2022, and the average plant capacity is 18,000 tons. However, the continuous decline in the overall capacity utilization rate is mainly due to the national capacity optimization and structural adjustment, the removal of excess and inferior capacity, so as to ensure the improvement of product quality and the effective control of output.

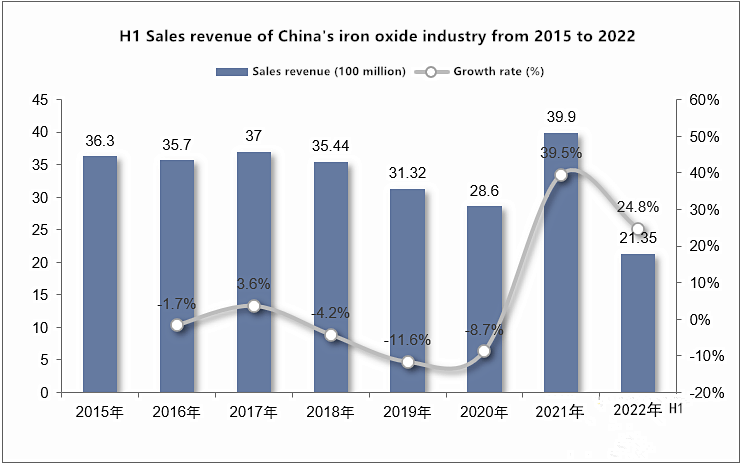

4. Sales revenue

Affected by the decreasing demand, the sales revenue of Chinese iron oxide industry has been declining in recent years, and will pick up in 2021. According to the data, the sales revenue of the iron oxide industry in 2021 was 3.99 billion yuan, with a year-on-year growth of 39.5%. By the first half of 2022, the sales revenue of China's iron oxide industry was 2.135 billion yuan, up 24.8 percent year-on-year.

5.Import and Export Trade

At present, China has become the world's largest iron oxide production trade country, has deeply integrated into the global industrial chain and supply chain, and gradually become a key pillar in the economic structure of China's iron oxide industry. According to the data, the import volume of iron oxide in 2021 is 215,000 tons, with an import amount of $119 million. Exports amounted to 352,500 tons and exports amounted to 396 million dollars.

From the perspective of export distribution, China's iron oxide exports are mainly concentrated in the United States, Europe and Southeast Asia, accounting for nearly 70% of the total export amount in 2021. The US accounted for 22.2 per cent, Europe 22.9 per cent and South-east Asia 24 per cent.

二、Competitive pattern

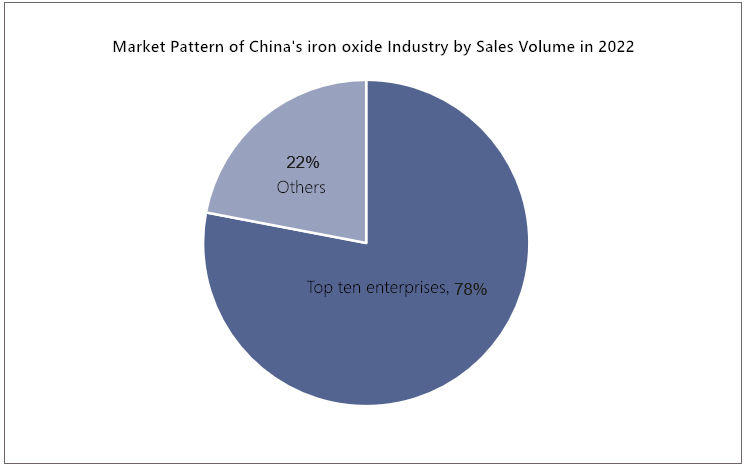

From the perspective of industry competition pattern, in the first half of 2022, the leading enterprises in the industry, such as Zhejiang Huayuan, Jiangsu Yuxing Technology, Yixing Huayi Yiping, Tongling Ruilai Technology, Zhejiang Yifan, Zhejiang Youcai, Zhejiang Deqing Meisle Pigment, Guangxi Haikang, Hunan Dezhiju and Hefei Zhangxun Environmental Protection Technology, produced 196,200 tons of products. Accounting for 67% of the total production of the industry; Sales volume was 202,300 tons, accounting for 78% of the industry's total sales volume. Among them, Zhejiang Huayuan, Jiangsu Yuxing Technology, Yixing Huayi Yipin, Tongling Ruilai Technology, Zhejiang Yifan, Zhejiang Youcai and many other enterprises have better sales and sales than the same period last year.

Post time: Feb-13-2023