Carbon black is one of the important functional materials in modern economy of our country, which can give other materials or products some special properties and play an irreplaceable role in many fields. The main categories include rubber carbon black, pigment carbon black, conductive carbon black, plastic carbon and various kinds of special purpose black.

Main application areas of carbon black

(1) rubber carbon black

Rubber products are carbon black as a good reinforcement, filler is the most widely used field, such as tires, tape, rubber hose, rubber plate, rubber shoes, and shock pads and other rubber products, sealing strip, sealing ring and other rubber products, car wipers, air conditioning pipe, oil seal, transmission belt and other kinds of industrial rubber products.

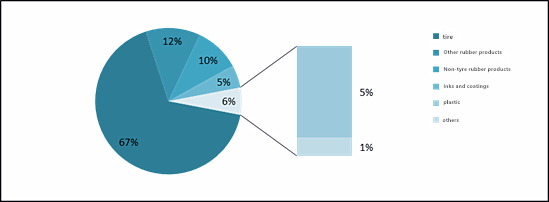

According to statistics, about 90% of the total carbon black consumption in 2019 was used for rubber products. Among them, in the field of tire, carbon black as the second raw material after raw rubber, the consumption accounts for about 67% of the total consumption. Therefore, the rubber carbon black market is closely related to the prosperity of the tire market, and the tire demand mainly depends on the automobile market demand.

(2) Other carbon black application markets

In addition to rubber products, carbon black as UV screen agent, antistatic agent or conductive agent, is also widely used in many fields, such as pigment carbon black is mainly used as paint, ink, plastic, chemical fiber and leather chemical coloring agent; Due to its low resistivity, conductive carbon black can make rubber or plastic have certain conductive properties, which can be used in cables, conductive rubber, oil hose, conveyor belt and other antistatic rubber.

With the continuous development and deepening of the application of carbon black in various fields, the market space will be broader.

Carbon market analysis

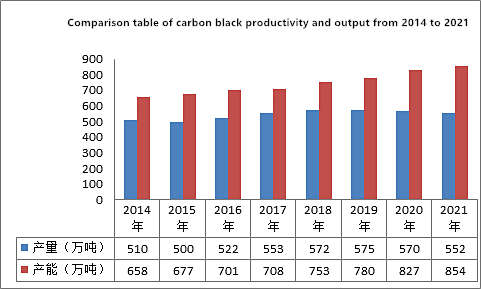

With the development of Chinese automobile industry, carbon production capacity of our country is expanding continuously. According to the statistics of Rubber Industry Yearbook, by 2020, China’s total carbon black production capacity has reached 8.27 million tons, making it one of the world’s major carbon black producers. However, there are still some structural gaps in our carbon black production capacity, which are reflected in:

(1) The capacity supply of some leading enterprises is still insufficient, and the improvement of market concentration is an important development path for the carbon black industry. For example, after the carbon black capacity reached its peak in the 1960s in the United States, the manufacturers and capacity installations gradually decreased, and the total capacity of the top five carbon black enterprises accounted for about 98% of the total national capacity. According to the statistical data of China Carbon Black Yearbook 2020, The production capacity of the top five carbon black enterprises only accounts for 43.19% of the national total.

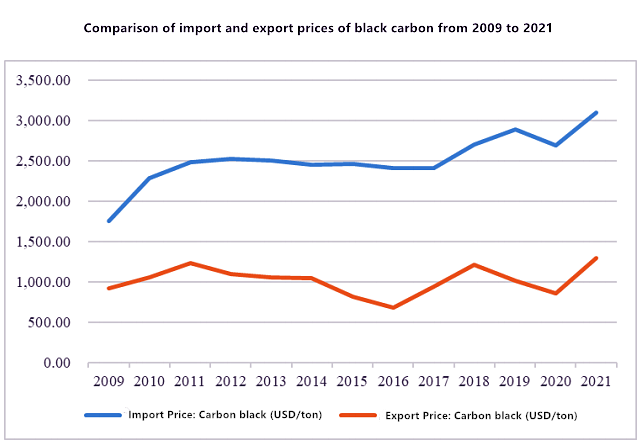

(2) Some high performance and special carbon black products still depend on import. Although China is one of the world’s main carbon black producers, some rubber carbon black varieties with high reinforcement, high wear resistance, low rolling resistance and high purity, as well as conductive carbon black, pigment carbon black and some special carbon black varieties still need to be imported, and there is a large capacity gap. Thus cause our country import and export carbon black price difference is huge.

The main factors affecting the market in 2022 are as follows:

Coal tar price capacity supply is tight. In the first half of the year, coal tar price has always remained high, and only in the later period began to decline slowly;

Second, due to the war between Russia and Ukraine, the import of black carbon from Russia in the early stage was blocked, and the price of energy and natural gas in Europe soared, so the cost of foreign black carbon enterprises increased a lot. Under various reasons, many downstream enterprises turned their attention to the import of black carbon from China, resulting in the export volume of black carbon increased to varying degrees in March, April and May. Iii. In the first half of the year, the epidemic broke out in a wide range across the country, which greatly hindered the logistics and transportation in all regions and increased the freight cost, which indirectly led to a series of increases in the price of carbon black. In summary, from January to May, the price of carbon black continued to increase due to various factors. From late May, tire enterprises started to carry a low load, and the product industry had limited enthusiasm for carbon black purchase, leading to a decline in the price of carbon black in June.

Post time: Dec-12-2022